Teach children to be smart shoppers

Back-to-school shopping is a major event that retailers hope to cash in on. Why not make the annual ritual an educational experience that teaches your child sound money management skills?

Plan and List

Begin in August while you still have down-time. Sit with your child and make a plan. List the items that will be needed based on last year’s experience. If your child is preparing to go to a new school, speak to other parents or call the school to determine the expectations.

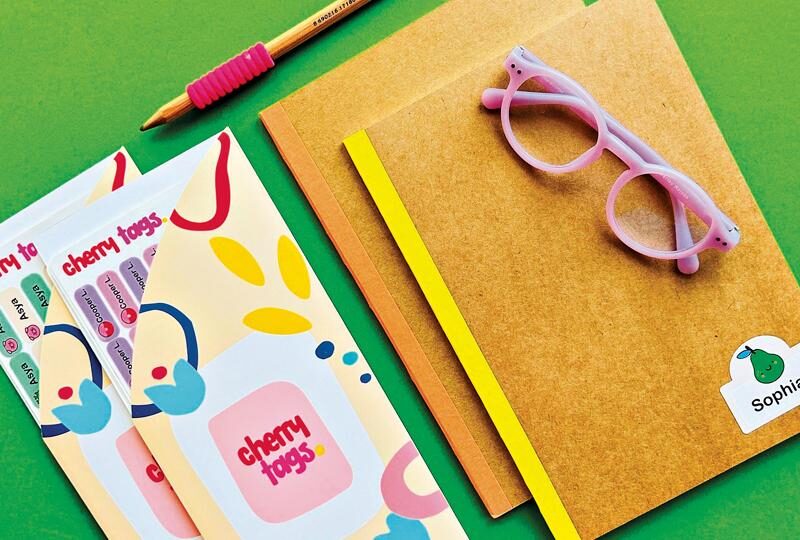

Each child should have his or her own list, which may include stationery supplies, books, knapsacks, lunch bags, gym clothes, uniforms or other clothing, and extra class fees for such items as art supplies or special calculators. Have them ask themselves whether each item is a ‘need’ or a ‘want’. Discuss the difference to help set priorities. Remember to include bus fare if your child will take public transit and a lunch allowance (daily or occasional). You may wish to include extras for purchases throughout the school year such as trips, accident insurance (a great buy if offered through the school) and photos.

Beside each item on the list have your child estimate the cost, and then have the child total the cost of all items. This will give everyone a clear idea of what it costs. Based on your personal financial situation, decide whether the total is manageable for you. If not, carefully review the list with your child and ask what is absolutely necessary and determine the maximum that you can afford to spend. Negotiate with your child what you are willing to pay for and what he or she may be responsible for out of allowance or part-time income.

Next, plan your shopping excursions. Determine what you can purchase in advance and plan to tackle these items before school starts to avoid the rush. Most stores stock school items early. Make short trips to keep your child’s focus and avoid shopping for everything on one day. Check local flyers for sales, discount coupons and manufacturers’ rebates. Stick to your list. Avoid heading out at meal time when you are hungry or tired as you are more likely to buy on impulse. More expensive items are usually exhibited at eye level, so teach your child to look at the display shelves above and below this area for lower priced items.

Forget that fabulous new fall outfit for the first day of classes. Often the weather is not suitable to wear it, and the sales will start by the time fall clothing is needed. Purchase clothing that has lasting value and that will endure washing throughout the season.

Do the Math

Have your child keep a tally of the running total of items purchased and compare it to the estimates to see how much is left on the projection. Offering an incentive to be thrifty might encourage the child to look for the best prices. The balance of the projected total expenses could be their reward.

Using cash or debit can help you stick to your limits. If using a credit card, limit your purchases to one card only to better track your outlay. Be sure to pay the bill in full, otherwise the interest added increases the cost of your purchases. Ask your child to keep all receipts in one spot to help track expenses and in case you need to return an item. An envelope serves as an easy file.

Hold off on the specific items that a teacher is likely to request until you have the list in hand, then check store hours to avoid the rush. Early-morning shopping may be less crowded than after dinner.

Life Skill

Kids are never too young to learn to be discerning consumers. It’s an important life skill. Teens who shop on their own quickly learn just how far their money can go. Teaching your child to be a wise shopper will be one of the more valuable lessons of the school year.

Carol Fraser is a Toronto-based Professional Home Economist who works for the Ontario Association of Credit Counselling Services (OACCS, www.oaccs.com).